Money Manager Ex (MMEX) is a free/libre, open-source, cross-platform, easy-to-use personal finance software. It helps organize finances and track cash flow.

MMEX includes all the basic features that 90% of users would want to see in a personal finance application. The design goals are to concentrate on simplicity and user-friendliness – an application that can be used everyday.

MMEX is financial management system for anyone to track money, currency, capital assets, spending habits. MMEX is based on simple principles, to allow anyone with little, to no knowledge of finance and general bookkeeping to successfully manage their finances. MMEX does this by modeling the real financial world, to help the user maintain personal finances. MMEX is gratis (without payment or charge) and open-source software.

The primary goal of MMEX is to simplify the process of tracking financial information, in an easy to use program that can be used as regularly as necessary, to help track where money comes from and more importantly, where money goes, in order to make better informed financial decisions.

MMEX could be thought of as a computer checkbook which enables the balancing of accounts and to organize, manage and generate reports for finances.

MMEX also helps keep abreast of financial worth.

The purpose of this manual is to give the reader some basic instructions for using MMEX. This instruction manual will evolve as the program evolves. So check the help system with each update and see what’s new and how to better utilize MMEX.

Becoming financially organized requires a certain amount of discipline. Financial management can quickly become complicated when there is no clear understanding of how much money we receive as income versus how much money we spend as expenses.

Debt usually occurs when our cash flow becomes limited because expenses exceed income. In these situations, we are often forced to borrow money in order to maintain sufficient cash flow to purchase essential goods.

The first step toward better financial health is maintaining accurate and up-to-date financial records. Only when we clearly understand where our money goes can we make informed decisions about where to reduce expenses during periods of financial strain. And if borrowing becomes necessary, we will also be better equipped to manage our debts.

Did you realize you spent $600 on DVD movies last year? How many times did you actually watch them? Looking back, would that $600 have been better spent on the unexpected car maintenance that came up yesterday? There is no right or wrong answer when it comes to how you choose to spend your money. After all, you earned it and have every right to spend it as you see fit. However, it is always possible to make your money work more efficiently and get the most value out of every dollar spent.

This is where personal finance software comes into play. Such tools help organize and analyze financial data, providing clearer insight into what is really happening. Always remember that software is only as good as the data it processes: incorrect data will inevitably produce incorrect results. But if you have already started considering the use of personal finance software, you are well on your way to making every dollar count.

Let’s now move on and see how to work with Money Manager Ex.

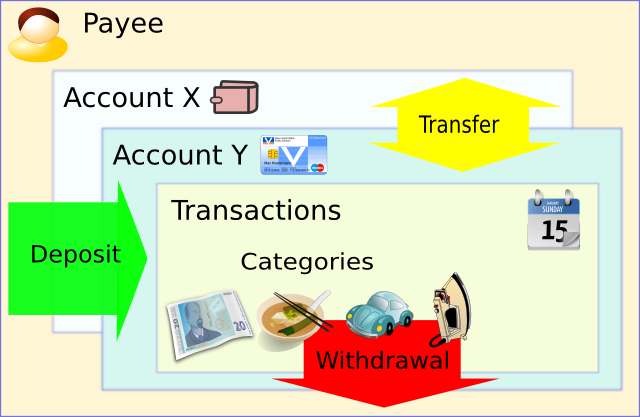

Money Manager Ex models the real world in order to help users manage their personal finances.

In everyday life, we usually receive money from someone in exchange for services we provide or products we sell. In MMEX, this is considered an Income or a Deposit. When we purchase goods or use services, the money we spend is considered an Expense or a Withdrawal. In MMEX, the people or organizations that give us money or receive our money are referred to as Payees.

Since we generally do not spend all the money we receive, we obviously need a place to store it. This may be a financial institution, several institutions, or simply cash in our pocket. MMEX refers to these places as Accounts.

Whenever we spend or receive money, this is recorded as a Transaction, and the reason for the income or expense is represented by a Category. In some situations, money needs to be moved from one place to another, such as withdrawing cash from an ATM (from a bank account to cash). This type of transaction is known as a Transfer.

This situation can be simplified as shown in the following diagram:

Another important aspect to consider is the currency used to perform transactions.

With all these elements to keep track of, MMEX uses a database to store and link all this information together.

The database generated by MMEX, known as the .mmb file,

becomes an important file that must be protected.

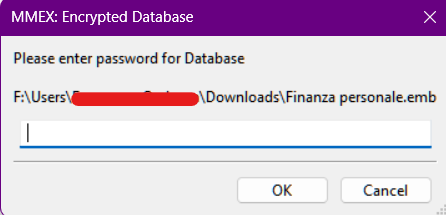

Depending on your needs, encryption can be used as a security measure,

resulting in an encrypted .emb database.

This allows a password to be attached to the database, which will be

required every time MMEX is opened.

As with any computer system, the data we generate is important and must be protected against system failures. MMEX includes a backup system that can automatically create dated backup copies when the database is opened and/or when changes are detected. Up to four backup copies are retained for each database.

.mmb or .emb database file regularly.In MMEX, all financial information (Accounts, Transactions, Categories, Currencies, Tags, Attachments, Settings, and more) is stored inside a single Database. This chapter explains how to create a new database, how to manage it properly, how to use encryption, how to open it on other devices, and how to perform reliable backups.

An MMEX database is a SQLite file and can use two different extensions:

.mmb – standard, unencrypted format;.emb – encrypted format protected by a password.MMEX allows the use of multiple databases (personal, family, business, testing, etc.). The name of the currently open database is always visible in the application’s title bar.

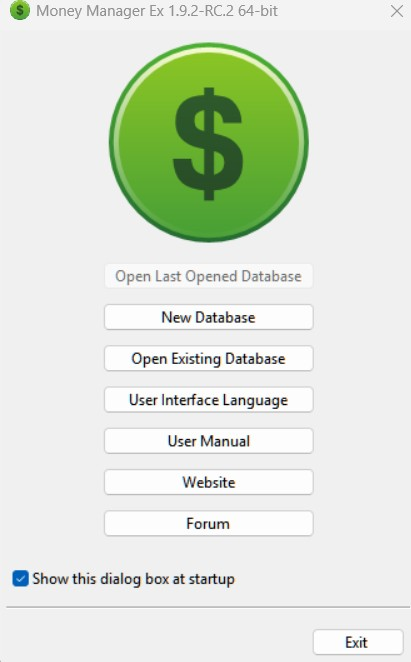

At startup, MMEX automatically attempts to load the last database that was used. If no database is found, the user is prompted to open an existing database or create a new one.

This is especially useful when working with multiple databases: the title bar makes it easy to immediately identify which database is currently open, reducing the risk of entering or modifying data in the wrong file.

To create a new database, choose:

File → New Database…

You will be asked to specify:

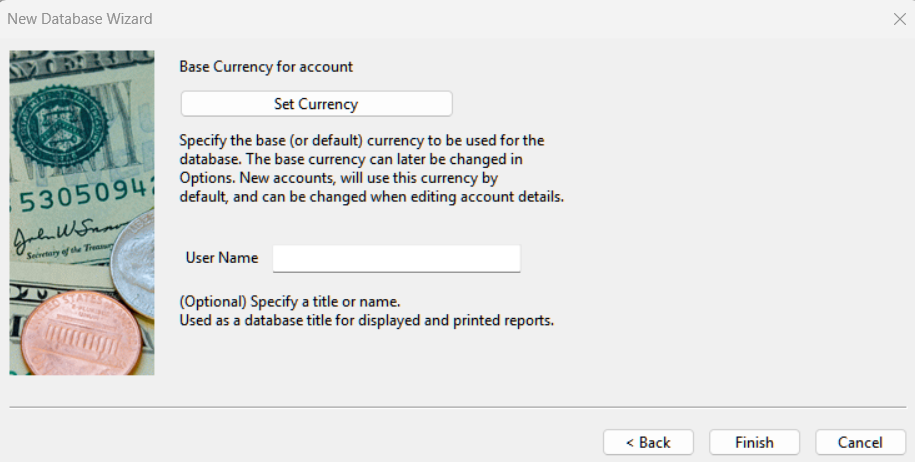

Finances.mmb).Once the file is saved, the New Database Wizard will start.

The wizard guides the user through the initial setup steps, helping not only to configure the database, but also to create the first account, which is required before transactions can be recorded.

The wizard requires two key pieces of information:

MMEX includes a set of predefined currencies, usually aligned with the user’s country settings. The Base Currency represents the main reference currency for the database: all reports and overall totals are calculated using this currency.

It is possible to create accounts in different currencies from the Base Currency. MMEX automatically manages exchange rates, allowing amounts expressed in different currencies to be compared correctly.

A complete explanation of currency management, exchange rates, and conversions is provided in the dedicated Currencies section.

The Base Currency also allows accounts in different currencies to be managed while maintaining a consistent overall view of the total value.

These settings can be changed later via:

Tools → Settings…

.mmb files are standard SQLite databases without encryption.

They can be opened by any MMEX installation and even by third-party tools.

.emb files use AES encryption and require a password to open.

They are strongly recommended when storing the database in the cloud,

transferring it between devices, or storing it on shared computers.

To convert an existing unencrypted database:

File → Save Database As…

Choose Encrypted Database (.emb).

Open the encrypted file, enter the password, then save it as:

File → Save Database As…

.mmb and .emb files are not device-locked.

You can copy them to any computer, cloud service, NAS, or USB drive and open them normally.

| Issue | Cause | Solution |

|---|---|---|

| Password not accepted | Incorrect case or keyboard layout | Check Caps Lock and keyboard language |

| Corrupted file | Application interrupted while saving | Restore from a backup |

| Version mismatch | Older version of MMEX cannot read new DB format | Update MMEX |

| Characteristic | .mmb | .emb |

|---|---|---|

| Security | Low | High (encrypted) |

| Password required | No | Yes |

| Performance | Faster | Slight overhead |

| External access | Possible via SQLite tools | Not possible |

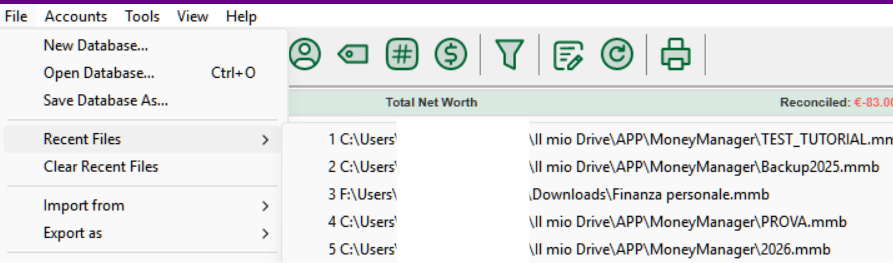

You can switch between recently used databases via:

File → Recent Files…

MMEX generates backup copies (.bak files) to protect your data from errors,

unexpected shutdowns, corruption, or incompatibilities with older database formats.

Backup options are located under:

Tools → Settings → Other

The available options are:

The backup filename is always based on the name of the main database

(dbname.mmb), with a suffix added automatically by MMEX:

dbname_start_YYYY-MM-DD.bakdbname_update_YYYY-MM-DD.bakDuring a single day, MMEX may create up to:

_start_YYYY-MM-DD.bak file (backup on startup), and_update_YYYY-MM-DD.bak file (backup on exit).Once a backup for that day has been created, MMEX does not update or overwrite it. Backup files are static snapshots of the database at the time they were created.

If additional changes are made during the same day:

.mmb) is updated,.bak files remain unchanged,

A .bak file is a static copy of the database as it existed at a specific moment.

MMEX never modifies or overwrites existing backup files.

dbname.mmb) to something like:Last_dbname.mmb

to avoid filename conflicts.

dbname_start_YYYY-MM-DD.bak or dbname_update_YYYY-MM-DD.bakdbname.mmb

Opening an older backup may cause MMEX to automatically apply scheduled transactions that fall between the backup date and the current date.

MMEX cannot mark a database file as read-only, but operating systems can.

| Issue | Cause | Solution |

|---|---|---|

| No .bak files created | Backups disabled or no database changes made | Check Tools → Settings → Other |

| Very long filenames | A backup file was mistakenly opened as the main database | Always use the .mmb file as your active database |

| Too many .bak files | Max Files set too high | Reduce the limit or clean older backups manually |

When creating a new database file, you will automatically be requested to create a new account.

To manually create a new account, from the menu, select Accounts → New Account….

This will bring up the Add Account Wizard. The wizard will assist in collecting the important information of the Name and Type of Account. The Account Type cannot be changed once it has been created, but the account name can be modified later when editing the account information.

The wizard guides the user through the initial setup steps required to start working with MMEX and ensures that at least one account is properly created before transactions can be recorded.

Name of the Account: This is a required field. The

recommendation is to name your accounts uniquely and in relation to

real-world accounts. Example: With CitiBank, we have a Savings

account and a credit card Visa account. You could name your

accounts as CitiBank Savings

and Citibank Visa

.

Type of Account: MMEX supports several types of accounts.

To properly set up accounts, you should have balance information for the accounts you want to add to MMEX. You can get this information from your most recent bank, investment and credit card statements. To track additional information about this account, optionally you can enter your account details such as account number, institution, website, contact information, and access details. You can enter additional notes about the account in the notes field.

Most accounts have some kind of balance in them, for example say in a credit card account, you have a current balance of $2,304.67, you could put that value in the initial balance field. From that point forward, you only need to add transactions that occurred after that date.

The Account Status can be set to Open or Closed. Closed accounts are just that. They are no longer active. Setting this status is just a way to declutter your view in the Navigator. Permanent settings are made by changing the View on the Menu, Tools → Settings…, you can hide the closed accounts. See Navigator Tips.

Currency: This is initially set to the database Base Currency setting which was initially set when creating the database. You can set the currency that is associated with this account and can be different to the base currency.

The exchange rate for the currency can be changed using the menu: Tools → Currency Manager….

Example: You live in the USA using US Dollars, and have an

Italian bank account using the Euro. Most of your accounts are in

USD. What is the real value of your Italian bank account? By

changing the exchange rate for the Italian Euro, you can get the

correct value of your accounts.

You can also mark accounts as a Favorite Account. This again is used to change the accounts that are visible in the Navigator. See Navigator Tips.

We have a savings account with $1,250, a check account with $500, a MasterCard owing $250, a Visa Card owing $475, a home mortgage loan of $230,965 and an education fund to send the children to college in the future currently at $5,000 earning interest.

We would set up the following accounts:

| Account Type | Account Name | Initial Balance |

|---|---|---|

| Check/Savings | Savings | $1,250.00 |

| Check | $500.00 | |

| MasterCard | -$250.00 | |

| Visa Card | -$475.00 | |

| Term | Home Mortgage | -$230,965.00 |

| Education Fund | $5,000.00 |

On the Dashboard the balances would be $1,025 for Bank accounts, and $-225,965 for Term Accounts

When a payment is made from your Savings Account to your MasterCard with a Transfer Transaction the balance on the Dashboard remains the same. When a payment is made from your savings to your home mortgage, the balance on the Dashboard will reflect the payment. Now you can determine the amount of money you have on a day to day basis. Regular payments can also be set up from your savings account to your mortgage account using Scheduled Transactions.

Once you have created an account, you can edit any of the account information fields in the following ways:

This will bring up the account information dialog where the required fields can be changed.

Edit the account details then use the OK button to save the account information.

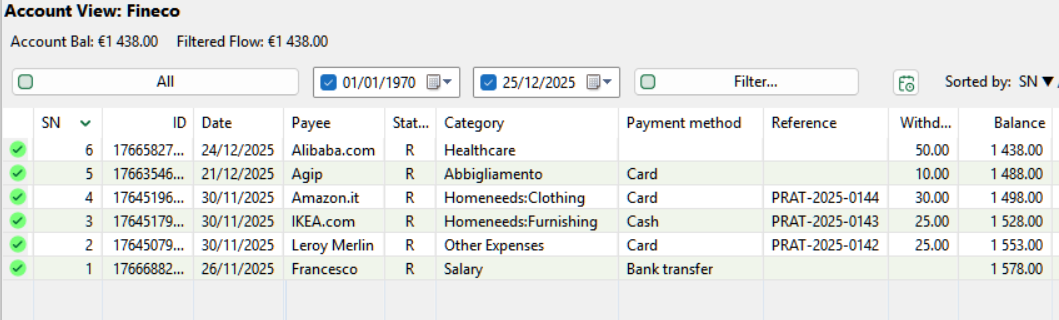

Once you have created a new account, and selected the required account from the Navigator, or the Dashboard, the displayed account can have new transactions added as follows:

A dialog will appear for new transactions. Use this dialog to enter the following details:

Editing existing transactions can be achieved in a number of ways:

Any of these actions will open the transaction dialog box containing the details of the selected transaction. Make the changes and click OK to save the changes.

Transactions can be filtered by either fixed filters or, by using the Transaction Filter in the Account View. This will allow the user to limit the visible transactions to those defined by the appropriate filter. These filtered transactions can then be easily selected and individually modified.

These visible transactions can also be deleted in bulk if so desired.

In MMEX, reconciled and unreconciled transactions are shown by different icons. When bank details are not checked against a bank statement, the user can select to set the default as Reconciled when creating transactions in the Settings.

For a convinient reconcile, a reconcile dialog is provided.

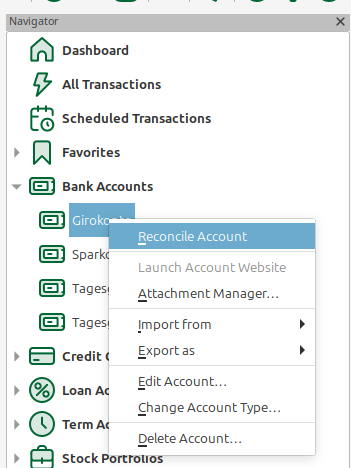

It can be either openend from the navigator right-click contextual menu of the account:

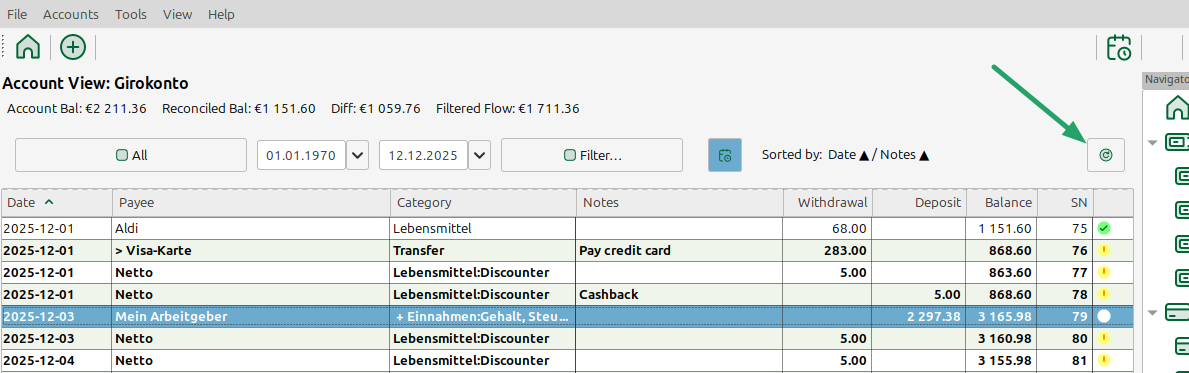

Or directly in the account view with the provided button:

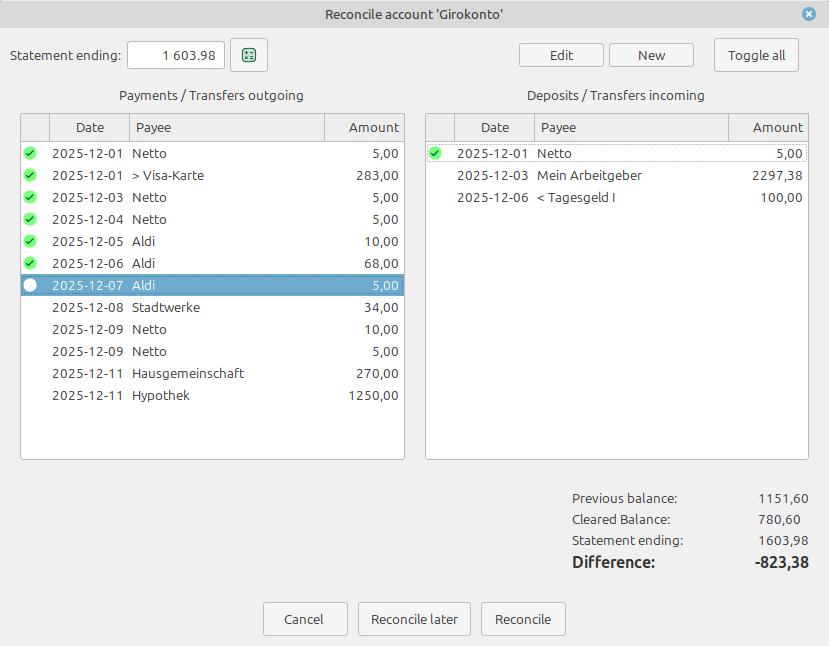

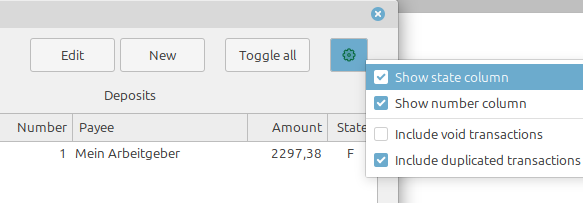

The dialog displays all pending transactions up to the current date sorted in two columns: one for withdrawels (payments and including transfers) and one for deposits including incoming transfers:

These options are stored and reapplied with the next invokement.

Per default "void" transactions are not shown in the dialog.

Some transactions might have some issues that you want to follow up on. Mark these as with status of flag for followup. This is indicated in MMEX with a different icon.

The user can specify 7 custom colors in under the Transaction Colors heading in the View section of the Settings. In the checking/term panel, pressing Ctrl+1 through Ctrl+7 sets the transaction entry color to the user specified custom color. Pressing Ctrl+0 will change it back to the MMEX default transaction color.

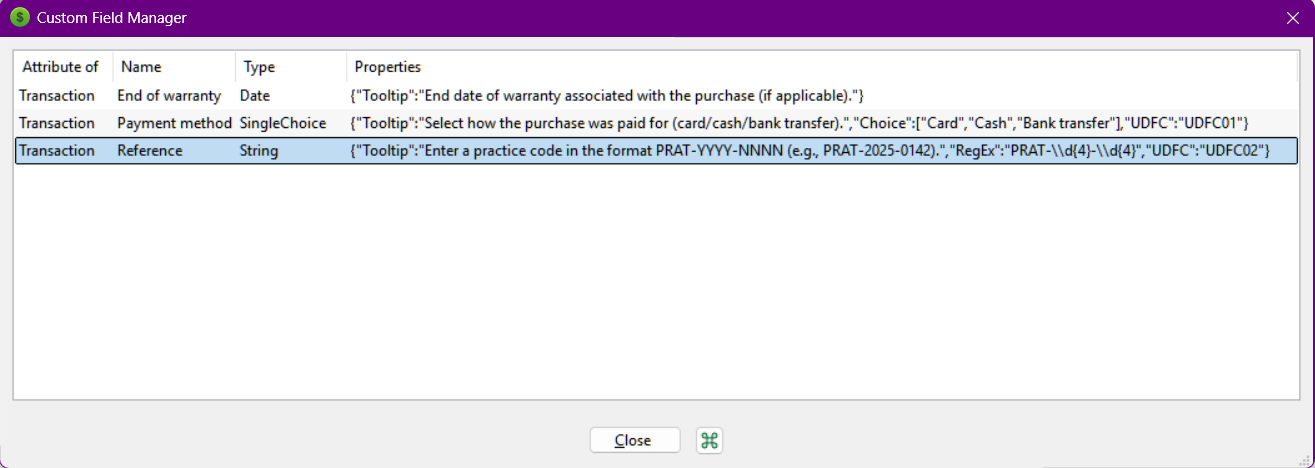

In MMEX, a transaction already has standard fields (Date, Payee, Category, Amount, Notes, etc.). In real life, however, information is often needed that does not have a natural place in these fields: a case ID, a payment method, an internal code, a project, a contract, a due date, a tag-based classification, a bank balance reported in the CSV, or the transaction type used by the bank (DD, CHQ, BGC…). Custom Fields are designed for exactly this purpose: they turn “informal” columns into consistent data, so you can import them, filter them, display them as columns, and use them in reports.

Many users import years of history from other finance apps or from bank/Excel exports. Those files frequently include extra columns (tags, comments, transaction type, references, balances, custom flags) that are extremely valuable for analysis and reconciliation, but cannot be reliably stored inside standard fields without losing meaning (for example, forcing a bank “transaction type” into Category is a compromise). Custom Fields were introduced to:

Before creating dozens of fields, it is advisable to define three key concepts:

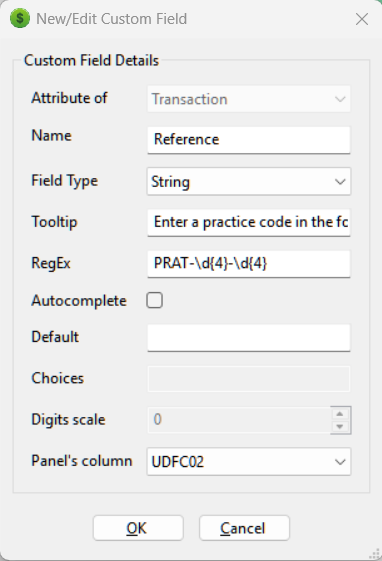

In the Custom Fields Manager you create, edit, and remove field definitions. A definition typically includes:

The choice of field type is not cosmetic: it determines what MMEX considers valid, how values are imported from CSV/XML, and how reliable it will be to filter and report that data.

CASE-\d{4}-\d{4} forces values like CASE-2025-0142.

;).

This is the closest “tag-like” approach, but controlled.

Custom Fields are useful whenever you want to separate accounting(Categories, accounts, transfers) from operational classification (projects, people, methods, codes, reconciliations). Typical scenarios include:

Categories describe “what you bought”. Payment method describes “how you paid”. With a “Payment method” custom field you can answer: “How much did I spend in cash last quarter?” without polluting categories.

Add a “Project” field to track cross-category initiatives: Category = “Home:Materials”, Project = “Bathroom renovation”. You keep both category reporting and project-based reporting.

When importing data from apps or banks that provide extra columns (tags, comments, bank transaction type, daily balances), Custom Fields are the correct way to bring everything into MMEX without compressing information into the Notes field. This is exactly one of the reasons why this feature is considered “powerful”: it allows faithful and verifiable migrations.

Using Date and Boolean fields, you can build a simple system to track deadlines such as “Warranty end” and “Renewed (Yes/No)”. Even though MMEX is not a full management system, this helps filter and locate related transactions and documents.

Once at least one Custom Field is defined for transactions, the New/Edit Transaction dialog displays a (usually expandable) Custom Fields section, where you can enter values specific to that transaction.

To see values directly in the account view, you can map up to 5 custom fields to the special columns

UDFC01…UDFC05.

In the CSV import dialog (and similarly for XML), MMEX displays the list of assignable fields.

After the standard fields, you will also find the Custom Fields, typically identified

by entries such as UDF: FIELDID next to the field description.

This allows you to map any extra column in your CSV to an existing Custom Field.

Recommended procedure (robust and repeatable):

When exporting to CSV/XML, the behavior depends on the version and the type of export selected. In general, if the goal is to “transfer data” from one MMEX database to another or to create an interoperable backup, it is advisable to verify that the export also includes Custom Fields and to always test with a small file first.

Custom Fields can be used in three main ways:

For advanced users (or those who want a “professional” manual): Custom Field values are stored in a dedicated table and linked to transactions via the transaction ID (REFID). This makes it possible to create SQL reports that also extract and aggregate Custom Field data.

SELECT

a.TRANSDATE,

a.TRANSAMOUNT,

p.PAYEENAME,

c.CONTENT AS CustomValue

FROM CHECKINGACCOUNT_V1 a

LEFT JOIN PAYEE_V1 p ON p.PAYEEID = a.PAYEEID

LEFT JOIN CUSTOMFIELDDATA_V1 c ON c.REFID = a.TRANSID

WHERE c.CONTENT = 'Card'

ORDER BY a.TRANSDATE;A robust workflow (especially for historical imports) is:

MMEX provides several tools to help users locate specific transactions within the database.

The quickest way to search transactions is by using the quick search field available in the account view. This search operates primarily on the Notes field and other visible transaction fields.

At the bottom of the transaction list in the account view, enter your search text in the field to the right of the magnifying glass icon. Click the magnifying glass or press the Enter key to start the search.

The search is applied only to the currently displayed account and processes all visible transactions. When working with large datasets (thousands of transactions), search operations may take a few seconds to complete.

For advanced searches based on amount, date, category, payee, custom fields, or complex criteria, it is recommended to use Transaction Filters or Transaction Reports, which provide far more detailed control.

To locate a specific payee, open the Payee Manager using:

Tools → Payee Manager…

In the payee management window, use the search field at the bottom of the dialog. This search is not case-sensitive, and the payee list is filtered dynamically as you type.

If you do not know the exact name or spelling of a payee, you can use wildcards:

For more details about managing payees, see the Payee Manager section.

Some fields, such as Categories and Subcategories, follow different search and selection rules depending on where they are used.

For example:

Searching within Custom Fields also has some limitations:

Payees are the people or institutions that give us money, or the people or institutions who we pay, for our goods and services.

You can manage Payees by using the menu item: Tools → Payee Manager….

Once the Payee Manager opens you can add new payees, edit or delete existing payees.

To Add a new Payee:

You can also select the payee in the list, then use the Edit or Delete button to perform the required action.

To delete a payee, ensure that no transactions use this payee. This can be done by:

This would then make the payee free so it can then be deleted.

Categories indicate the reason an expenditure is made or an income is received.

A Category is generally used to record Income or Expenses. Because MMEX allows us to transfer money between accounts, it is also recommended to use categories to record transfers. This will allow us to determine what money is being transferred for a specific reason, such as a repayment to a loan. This will not be seen as an income or expense in the overall picture. Using the same category for an income and an expense will upset balance figures.

Example: If we want to record the value of running a car, we would set up the following:

The first 4 subcategories are used to record expenses. If we are reimbursed for fuel costs for any reason, we would need to use Fuel Reimbursed as an Income subcategory. This would then allow us to determine the correct amount we are spending on fuel to run the car. This will become clearer when we are using Budgets.

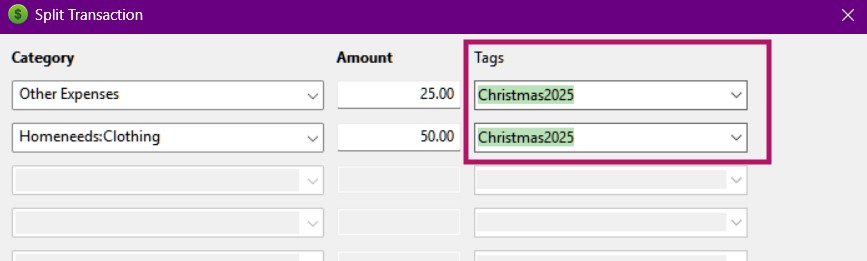

When adding a new transaction, we can use more that one category to record a transaction. This is known as a split category.

The overall split category transaction is either a withdrawal or a deposit. Although the categories within the split, need to reflect the overall transaction type, each category can be classified as a withdrawal or deposit within the split.

Split categories can easily be viewed for a transaction by using a contextual menu selection when a split category entry exists.

You can manage Categories by using the menu item: Tools → Category Manager…. Once the category dialog opens, you can add new categories and subcategories.

To Add a new Category:

To Add a new Subcategory:

You can also change the names by selecting the category/subcategory in the list, use the Edit button, modify the name in the text box, then use the OK button. Use a similar action to delete the category/subcategory in the list.

Ensure that no transactions use this category/subcategory combination. This can be done by:

This would then make the category free so it can then be deleted.

You can nest subcategories, with information available here: nested categories #1477.

Tags are an advanced classification tool that allow you to assign contextual information to transactions, independently of Categories, Accounts, or Payees. While Categories describe the nature of an expense or income, Tags describe the purpose, project, person, event, or context related to that transaction.

Tags were introduced to provide a more flexible classification system than Categories alone. A Category defines “what type” of transaction was made; a Tag defines “why” the transaction was made or “in which context” it belongs.

Tags are especially useful when:

Using Tags keeps your Category structure clean while allowing deep and flexible analysis.

The Tags field is available in the New/Edit Transaction window. You can:

Tags also work with split transactions, allowing you to classify complex entries

with multiple Categories.

All Tags can be viewed and modified using:

Tools → Tag Manager…

From this window you can:

Tag names must follow specific rules to ensure correct behavior within MMEX reports, search filters, the database, and import/export systems:

_) → Trip_New_York[ ] { } ( ) % $ # @ ! ? *.

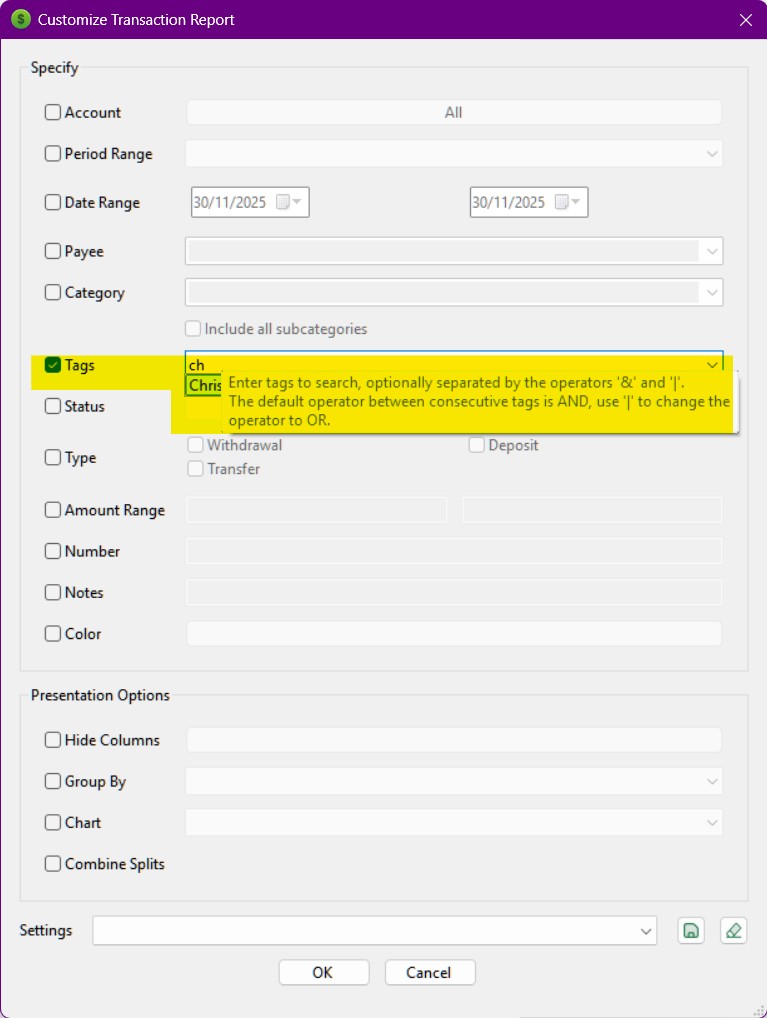

The Transaction Report fully supports Tag-based filtering.

Reports → Transactions

Filter options include:

Hotels, taxis, restaurants → Tag: Vacation2025

Materials, labor, tools → Tag: BathroomRenovation

Groceries, utilities → Tags: Marco, Angela

Bills, maintenance, taxes → Tag: CityCenterHouse

MMEX can be used in many countries, MMEX need to consider the currency for the country of use. When creating a new database, the Base Currency is set to the currency used in the user’s country. If the user’s currency setting is not listed in the default currencies, the user can create their own currency Listing.

MMEX allows us to work with more than one currency. Each account has its own currency setting, and will default to the base currency. When we set accounts with different currencies, the transactions we create in these accounts will reflect the currency of the account.

You can manage Currencies by using the menu item: Tools → Currency Manager….

Add a new Currency:

When more than one currency is being used, the Conversion to

Base Rate needs to be set. This will allow the value of the

currency to properly reflect the value at the base rate.

To allow Automatic Currency update, the Currency Symbol needs

to be set for the particular currency being used.

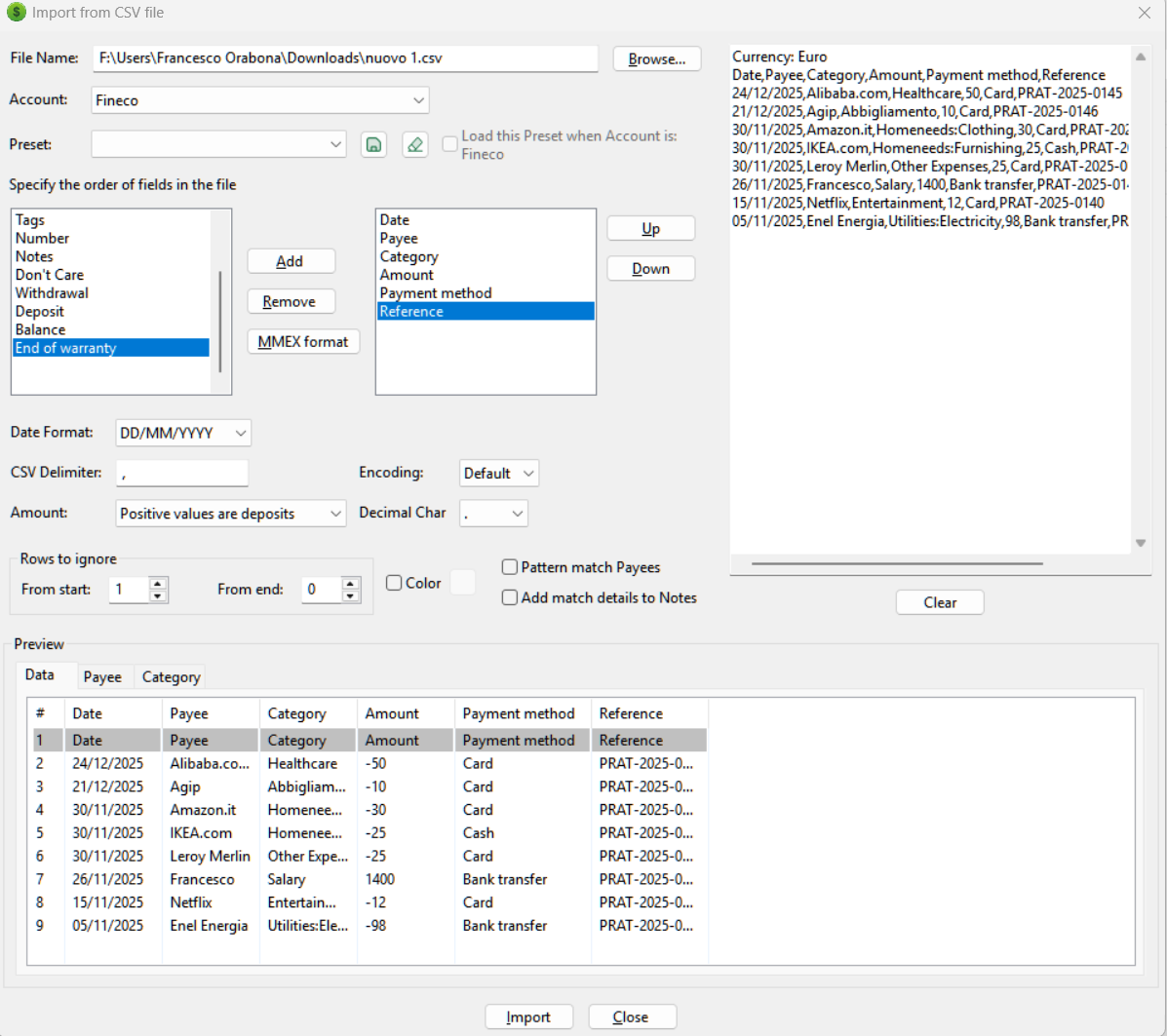

To alleviate the problem of users having to pre-format their bank transaction CSV files into the fixed format MMEX requires, MMEX also allows users to import CSV files where the order of fields is completely freeform.

To use this importer, select the account you want to import into and then select the order of fields in the CSV file by picking and choosing from the list of possible fields. MMEX will now import the CSV file using the format information specified by the user.

MMEX can import from a wide

variety of formats. One of them is a fixed format CSV file. This

file format exactly matches the CSV format that MMEX can export. So

it can be useful to move data from one .mmb database file to

another .mmb database file. To easily see the format of the CSV

file, you can try exporting an account to a CSV file and then

analyzing the format created.

The CSV field options are as follows:

When creating your CSV file be sure that you remove the commas from your deposits and withdrawals. This can be done easily using a spreadsheet program such as LibreOffice Calc.

After importing from CSV, all transactions will have a Follow Flag as it its status. You can mark all transactions with this flag using the bulk status setting commands using the right-click contextual menu in the account view.

When importing CSV files that contain extra columns (such as payment methods, references, project codes, or bank-specific transaction types), consider using Custom Fields to preserve this information as structured data instead of placing everything into Notes.

Importing from XML files recognizes XML files in Excel format

named XML Spreadsheet 2003

in Excel. This is the recommended

import method if required to import transactions from Excel.

Method of import and field selection is same as importing from CSV files.

Quicken Interchange Format (QIF) is an open specification for reading and writing financial data to media (i.e. files). A QIF file typically has the following structure:

!Type:type identifier string [single character line code]Literal String Data ... ^ [single character line code]Literal String Data ... ^

Each record ends with a ^ (caret).

See example QIF transaction:

!Type:Bank Header

D6/ 1/94 Date

T-1,000.00 Amount

N1005 number

PBank Of Mortgage Payee

^ End of transaction

QIF is older than Open Financial Exchange (OFX). The inability to reconcile imported transactions against the current account information is one of the primary shortcomings of QIF. It is commonly supported by financial institutions to supply downloadable information to account holders.

MMEX can import transactions from specific types of QIF formats into an account (you can find the type of QIF by opening in a text editor)

After importing from QIF files, all transactions will have a Follow Flag as it its status. You can mark all transactions with this flag using the bulk status setting commands using the right-click contextual menu in the account view.

MMEX has a light WebApp that can be installed on every PHP webserver like NAS, shared hosting or other PHP local installation.

You can download all needed files from WebApp project page.

To start-up WebApp you only have to:

htaccess.txt in .htaccess (on Windows you need to do

it from CMD and rename command)

PDO_SQLite if neededThen simply open your browser to the folder URL, fill first settings and insert correct URL and GUID in MMEX settings (import/export tab).

Now at every start-up MMEX will contact WebApp for new transaction that will be downloaded and imported in desktop database.

All main transaction linked settings will be automatically synced to WebApp, in this way you can have all your account and payees ready to use inserting new transaction.

MMEX can export as a fixed format CSV file. This file format

exactly matches the CSV format that MMEX can import. So it can be

useful to move data from one .mmb database file to another .mmb

database file. To easily see the format of the CSV file, you can

try exporting an account to a CSV file and then analyzing the

format created.

The general format is as follows:

MMEX can export as an XML file. The XML format is compliant with, and can be read by, spreadsheet programs such as LibreOffice Calc. The general format is the same as CSV.

MMEX can export an account to a file of the QIF format. This format can also be used by MMEX to reload into an account.

Scheduled Transactions are special transactions that we set up in order to have the transaction entered into the database at some future date. These transactions generally occur at regular intervals, such as the payment of a bill.

These transactions:

Scheduled Transactions can be accessed from the Navigator or from the menu item Tools → Scheduled Transactions. This will display the Scheduled Transactions page.

To create a new transaction, use the New button:

To create a scheduled transaction from an existing transaction, select and right-click on the transaction to bring up the contextual menu and select Create Scheduled Transaction….

MMEX allows you to track Stocks and Shares. The total Stocks are added to your total financial worth.

Further details refer to Stocks, Shares and Share Dividend Management in MMEX

MMEX allows you to track fixed assets like cars, houses, land and others. Each asset can have its value appreciate by a certain rate per year, depreciate by a certain rate per year, or not change in value.

The total assets are added to your total financial worth.

Assets are accessed via the Tools →

Assets or via the Navigator.

Assets are created in the Asset Management window.

Asset transactions are added to an asset and tied to an account.

MMEX allows a variety of reports. Select the appropriate report under the Reports node in the Navigator. Some reports require some user input, some do not.

These reports are generally used for tax purposes which do not necessarily start at the beginning of the calendar year. These reports cover:

The start date can be changed by the user to start on any day of any month, within a 12 month period by using the menu Tools → Settings… → General.

This allows the user to generate specific reports based on user selected criteria.

A Transaction Report is generally used to locate specific transactions made within Bank or Term type accounts. This report can also be used to display specific details for a particular account.

For a Transaction Report, the resulting list of transactions can be printed or saved as a HTML file.

If your transactions use Custom Fields, these can also be leveraged in filters and reports (depending on the version), or more extensively through SQL-based reports in the General Report Manager.

Since a transfer transaction is a withdrawal from one account and a deposit to another account, a transaction report done on multiple accounts loses the reference point for determining whether the transaction is a deposit or withdrawal.

When a transaction report is used for a specific account, it will generate a report that will match the account details. The reference point for transfers in known for this report, which will reflect in the report having correct balances displayed.

This report projects the amount of funds available, based on future commitments.

The report will use the Scheduled Transactions for the various accounts, and reflect forward 10 years on a monthly basis. This becomes a prediction of the amount of money that may be available each month based on current payments.

MMEX supports printing of all reports that can be viewed.

Once you view a report, you can print the report using the File → Print… menu.

You can modify some runtime behavior of MMEX by changing the options in the Settings dialog.

It is accessed from the menu with Tools → Settings… or from the tool bar.

The dialog window is divided in panels, which structure the settings and can be invoked by the symbols on the left side.

These settings control the dashboard display.

See Toolbar configuration how to change the appearence of the toolbar

See Navigator configuration and custom account types how to change the appearence of the navigator and to create custom account types

You can contribute by:

MMEX was originally developed as a personal finance software called Money Manager. It was written in .NET and was more of a learning exercise than serious software development. It grew far beyond the original design. The software was frozen and work began on a new version which had a similar user interface and features, but written in C++.

Usually Microsoft names their second version of their improved

software APIs with an Ex extension as in doSomething() and

doSomethingEx(). This convention was followed so an ‘Ex’

was appended.

The database structure is documented at https://github.com/moneymanagerex/database, the diagram is up-to-date for the current MMEX database version (v19). Clicking on it leads to the interactive version.

.mmb format proprietary?No, .mmb file is not proprietary.

MMEX uses SQLite databases to store user data. That

means that the .mmb file is a regular SQLite database.

SQLite is one of the smallest, free relational database

systems around and there are tons of tools to open and

access SQLite databases. SQLiteSpy,

SQLite Browser

, and wxSQLitePlus

are such utilities. Once you open the database using these tools,

you can do anything you want with the data.

Yes. Your data is completely safe.

The data is self contained on your PC, (or USB stick if you have made it portable). To further protect your data, encryption can now be added. This applies a password to your database file, and can only be opened by MMEX or any other software if you have the correct password.

Yes.

MMEX is a portable application which means ability to run

without installation, for example, from USB flash drive. If MMEX

finds mmexini.db3 in its folder, it assumes portable

mode. Copy MMEX’s files to USB Key and copy yours

mmexini.db3 to MMEX’s folder on that drive.

To make MMEX portable:

F:\ is USB flash drive)

C:\Program Files\MoneyManagerEx to

F:\%APPDATA%\MoneyManagerEx\mmexini.db3 to

F:\MoneyManagerExF:\/media/disk is mounted USB flash drive)

make install prefix=/media/disk cp ~/.mmex/mmexini.db3 /media/disk/mmex/share/mmex

/usr:

cp /usr/bin/mmex /media/disk/mmex/bin cp /usr/share/mmex /media/disk/mmex/share cp /usr/share/doc/mmex /media/disk/mmex/share/doc cp ~/.mmex/mmexini.db3 /media/disk/mmex/share/mmex

Generally, with any closed-source program, you have to depend upon the vendor’s word regarding safety of the data. But with MMEX being open-source, you can verify this claim yourself.

Even if you are not a C++ expert, you can rest assured that anyone can access the source code at any time and verify the legitimacy of MMEX’s intentions.

MMEX does connect to the internet only to send anonymous usage statistics or when checking for an update. Here is a sample of data that MMEX will send:

| Version | Operating System | Language | Country | Resolution | Start Time | End Time |

|---|---|---|---|---|---|---|

| 1.3.0 Portable | Windows 8 (build 9200), 64-bit edition | english | United States | 1366x768 | 2014-05-01 09:00:00 | 2014-05-01 09:01:30 |

To print a statement with transactions from any arbitrary set of criteria, use the Transaction Filter to select the transactions you want and then do a print from the File → Print… menu.

The Transaction Filter is accessed from Reports → Cash Flow → Transactions in the Navigator.